With interest rates normalising and economic resilience reviving risk appetite, global markets are entering a slow recovery phase. Central banks are cutting rates to stimulate demand, while investors are advised to pursue diversified strategies amid the tech-heavy bias. Key sectors for investing include technology, cybersecurity and clean energy, overlaid with long-term market patterns suggesting a bullish outlook until 2026.

As inflation subsides and interest rates trend towards pre-pandemic levels, global markets are expected to endure a near-term easing cycle — though more gradually and to a lesser extent than the dramatic ebb and flow of the past 5 years that decelerated markets to recessionary territory.

‘Sit tight, buckle up, as the world braces for market disorder’ was the tune of yesteryear. ‘Hang tight, equity up’ seems fitting for recovering markets with increasing monetary support and steady growth prospects for 2025.

Banking on interest

Entering the fourth quarter of a period marked by disinflation and economic resilience, the year of the dragon has shown leniency for capital markets.

With the world gradually rebounding from the economic entropy of 2022, falling interest rates in the West have captivated headlines as central banks finally commence lowering rates in an effort to stimulate demand and investment.

As of last month, the Federal Reserve cut US interest rates for the first time since 2020. The Fed’s aggressive monetary policy aligns with its ‘dual mandate’ of controlling inflation by balancing price increases with low unemployment. The European Central Bank (ECB) and Bank of England (BoE) have signalled similar intent, with the ECB cutting rates by a cumulative 0.5 percentage points since May, and the BoE reducing rates by 0.25 percentage points since July.

With inflation cooling, central banks will cautiously moderate interest rate hikes keeping a close eye on global supply chain disruptions and geopolitical tensions. Although US consumer spending remains robust, businesses are expected to scale back on operations, seeking efficiency gains to course-correct from four years of economic deflation. This slow recovery may affect investment confidence, but stimulus plans are likely to revive risk appetite — with Rothschild & Co reporting a rise in global stocks to all-time highs as China unveils new stimulus measures.

In contrast, the European economic situation — exacerbated by energy supply issues and a tighter financial climate — appears far more delicate, with inflation refusing to budge and growth declining. Additionally, future debt burdens are poised to rise significantly without fiscal intervention, a core issue which governments will attempt to address through cost-efficiency initiatives.

Investing wisely

Reflecting on the past 15+ years, economic theory sheds light on the broader effects of turbulent market cycles. As illustrated in the above chart, despite the significant ebb and flow of global markets — enduring volatility from both the 2007/08 crash and the post-pandemic rebound — an annualised total market return of approx. 13% was realised.

Evidently, investing in the S&P 500 index of leading company shares returns double-digit dividends in the long run.

So what advice could the average person use for their investment strategy?

Princeton University economist, Burton G. Malkiel summarises the thirteen editions of his book, ‘A Random Walk Down Wall Street’ into the simple yet timeless advice of ‘broad diversification, annual rebalancing, using index funds, and staying the course’. This advice couldn’t be more relevant as global markets head into an easing cycle, poised with European and US equity market futures firmly in the green.

Smart investing with the proverbial ‘Benner Cycle’

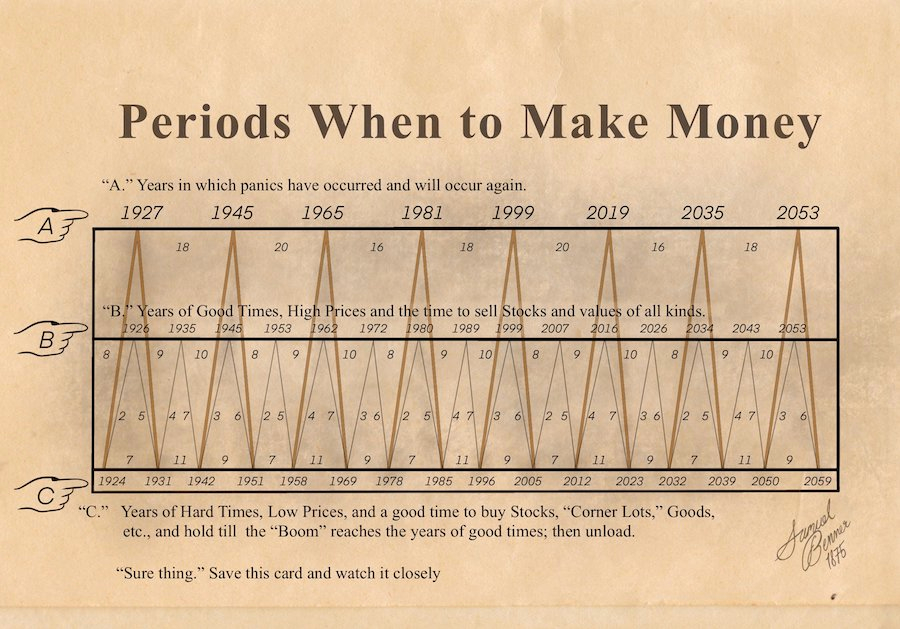

Devised in the 19th century and referred to by many analysts as an eerily accurate indicator of historical economic cycles, Samuel Benner’s timeless 150-year chart predicted the 1929 stock market crash, the dotcom bubble, and, to a lesser extent, the 2007-08 ‘big short’.

While advisory about cyclical economics from a prophetic pig farmer is certainly not a standalone cheat sheet to forecasting global markets, one can reasonably deduce bullish sentiment projected until 2026, followed by subsequent bearish territory. When that downturn will occur exactly is unknown, but keeping in mind such periodic dynamics can aid objectivity in selecting an appropriate path for your investment return horizon.

Industries of interest

With an expansionary mid-term outlook, what industries are investors contemplating? How are global sectors positioned for growth and environmental impact? Will the tech-heavy bias outweigh the trend towards diversification in this interest rate easing cycle?

While no perfect investment portfolio exists in prosocial alignment with environmental targets, there are innovative ways to integrate net-zero ETFs that support reputable funds with strong sustainability commitments.

The impact matrix below showcases a crossroads of diverging industries and the paradoxical effects of emerging niches and rising stars amid soaring growth.

Getting granular, below is a list of shortlisted securities across six sectors, with technology, cybersecurity, clean energy, biotechnology, AI, and mobility all leading the way.